Savings Safari: Seize Opportunities to Teach Kids About Money

Savings Safari is a mobile application that I designed as a mentee in the product design track of the Chicago AIGA chapter’s Mentorship Program in the spring of 2019. I was responsible for all aspects of research, design, and testing of the app. Thank you to mentor Masha Safina and fellow mentees for participating in user tests and providing helpful feedback throughout the process.

The Problem

As parents, it is too easy to miss opportunities to teach our children to be smart about saving money. For example, as the parent of a young child, I know I have had a tendency to talk with my child about money only while shopping. This reactive approach misses opportunities to frame the discussion around saving and long-term planning as opposed to short-term spending.

User Insights

Upon doing some secondary research and surveying parents, I found that I was not alone in my habits or concerns. What’s more, many kids are already thinking about money from an early age. They have their own kind of wisdom!

Some parents I surveyed shared fascinating questions and observations posed by their children.

Behavior and Cognition Around Finances

Childhood ability to delay gratification is linked to success into adulthood (See Mischel’s “Marshmallow Test”).

Children are more inclined to delay gratification when authority figures keep their promises (delivering on allowance promises, paying back money borrowed, etc.).

Expressing gratitude boosts our ability to delay gratification.

By age 7, most children can set goals and are open to input on how to achieve those goals.

When teaching children ages 5-8 about money, it’s best to use cash.

Don’t link all chores to money.

Make saving an automatic habit.

Sources:

Dungan, Nathan. Prodigal Sons and Material Girls: How Not to Be Your Child’s ATM. Wiley, 2003.

Godfrey, Neale S. Money Doesn’t Grow on Trees. Simon & Schuster, 2006.

Kobliner, Beth. Make Your Kid a Money Genius (Even if You’re Not). Simon & Schuster, 2017.

Parents Feel Underprepared

According to a Visa USA survey, 56 percent of parents surveyed in 2004 believe their high school graduates are unprepared to responsibly manage personal finances. And according to a 2003 FleetBoston survey, only 26 percent of parents surveyed feel well-prepared to teach their children about finances, and fewer than half of parents consider themselves positive role models for their children, financially.

Survey Findings

I wrote and fielded a short questionnaire to learn about parents’ priorities, attitudes, hopes, and fears around teaching their children about spending and saving. The responses (from 13 parents) are described below.

Most parents want to teach their children about avoiding debt and committing to long-term saving.

A score of 5 indicates “very effective,” and a score of 1 means “not effective at all.”

Most parents rate themselves as only “somewhat effective” in teaching their children about money and finances.

Parents tend to talk with their children about money while shopping or in transit.

Most parents surveyed did not currently give a regular allowance to their children.

Open-Ended Responses to Questions:

Is there anything specific you wish you could better teach your child about money?

What is most annoying or inconvenient about teaching about money?

Has your child posed any questions or comments that you’d like to share?

Do you have any fears with regard to teaching your child about money?

Competitive Analysis

A number of terrific digital tools are already available to support conversations between parents and children about money.

Most available apps track allowances and chore completion.

Some apps facilitate working toward goals, and many help families separate funds for saving, spending, and giving.

Most apps fall into one of two categories: 1) educational games, or 2) managing allowances.

In the current competitive landscape, there are opportunities to combine educational tools with goal setting and goal management. And given that many parent/child conversations about money happen during shopping trips, there’s an opportunity to be mindful of this context.

Defining the Problem

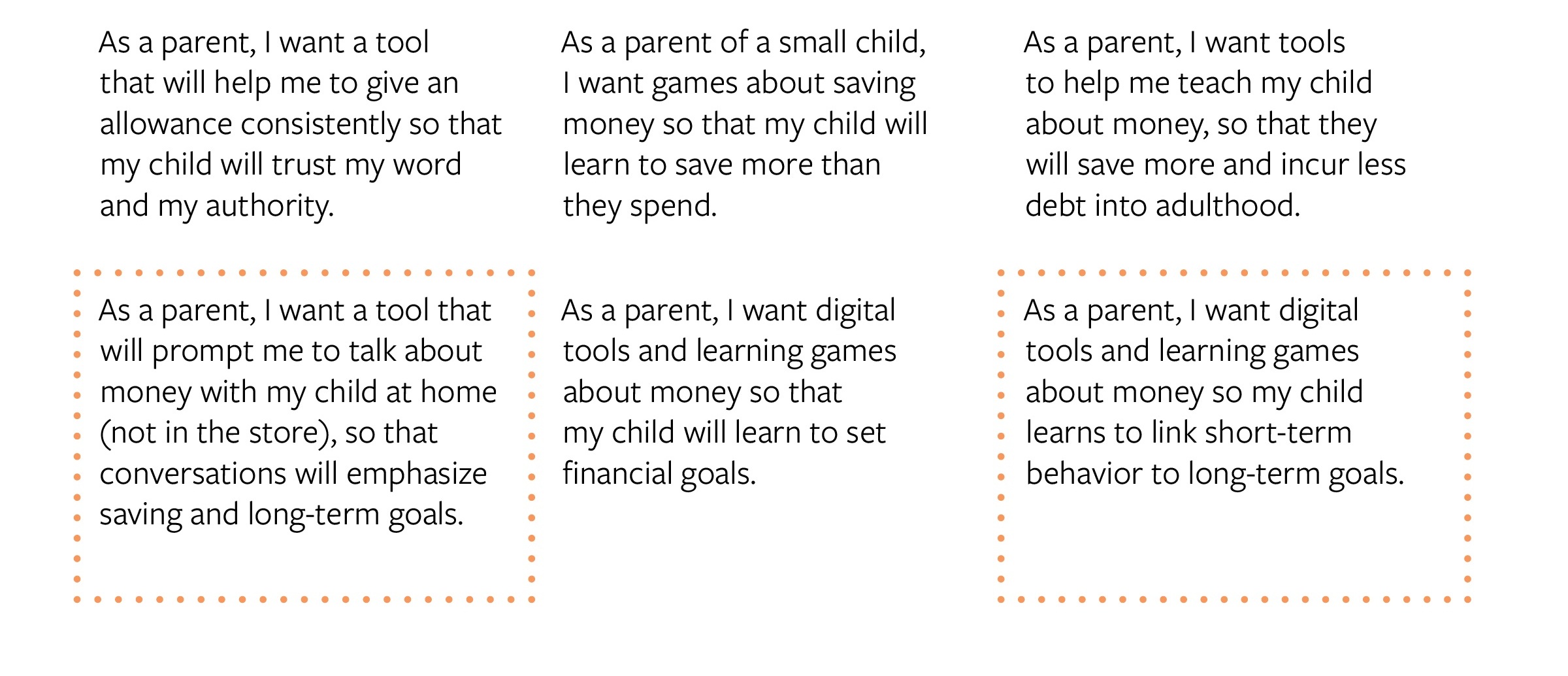

User Stories

How might we… ?

Turn trips to the store into learning opportunities?

Turn kids’ asking for stuff in the store into teachable moments?

Teach kids about the longer-term benefits of saving?

Gamify delaying gratification?

Best teach our children about being smart with money?

Storyboard

Savings Safari, as initially conceived, would intervene in conversations between parents and their children in the context of shopping.

Initial Prototype

User flow

Parents would first create profiles in the app for each of their children. Parents can set up an allowance amount and frequency and a savings goal for each child. Later, when a child asks to make a purchase, the parent would give the child the parent’s smartphone for a moment, opened to the child’s profile within the app.

Wireframes of registration process

After being handed their parent’s smartphone, the child would play a short decision-making game in which they would either win or lose points depending on whether or not they choose to make a desired purchase.

Wireframes of children’s game screens

User Test Feedback

User testing on early iterations yielded the following feedback:

Make language clear and age-appropriate.

“Form of address” is an unfamiliar and overly formal phrase. Better to ask, “What does your child call you?”

Copy works well where it is concise, clear, and conversational (“Look for accounts,” “Ask Mom to move money,” etc.)

“Go” button labels should be changed to “Next,” or “Okay.”

In the children’s screens, use language that kids would use. “Gadget,” isn’t common parlance among kids, but “games” or “electronics” might be.

Be mindful of design patterns.

Only the home screen should look like a home screen.

Avoid excessive back buttons.

Clarity!

More product information would be helpful in walkthrough.

On the screens where users allocate allowance and other funds to four different accounts (spend, save, give, or invest), include definitions of these four account categories.

Need a bit of explanatory copy on parental access passcode setting screen.

Be sure to use images and headers and break up large blocks of text, particularly in the children’s screens.

On setup screens, be sure to use a progress marker to make the number of steps clear.

Back to the Sketchbook

High Fidelity Screens

Limitations and Considerations

Behavior Design Challenges

While designing Savings Safari, a challenge came to light: Children’s concept of time is different from that of adults, and kids would probably not find a game as time-distributed as the one described above very interesting or persuasive. This necessitates the design of a children’s game within the app that would be immediate and interactive in more concrete ways, so that kids find it meaningful and compelling.

Ethical Challenges

Kids trust technology much more than most parents would. In fact, the depth of children’s trust in technology is actually quite disturbing. In addition, using a technology-mediated way of simply saying “no” (“We’re not going to buy that.”) to one’s child could erode the quality of the parent-child relationship. It robs the child of an opportunity to practice managing their emotions. Should this really be an app, or a conversation between parent and child?

Changing Course

To address the need to move parent-child conversations about money from the shopping setting to the home or to other contexts of use, an app-based children’s game should not be played in the store, but rather at home on a tablet or desktop. By this way, kids are prompted to think about the value of money in the context other than shopping.